글번호 : 54508561

작성일 : 15.04.08 | 조회수 : 319

| 제목 : China Wants to Buy Europe | 글쓴이 : eu-center |

|

|

|

|

China Wants to Buy Europe MAR 23, 2015.

Chinese investors have a powerful attraction to companies in the European Union, and their targets are increasingly high-profile. In recent days, they've shown interest in an 18-building compound on Berlin's Potsdamer Platz and in the Italian tire-maker Pirelli. For some unfathomable reason, Europe considers Chinese investors, even state-owned ones, more benign than, say, Russian ones.

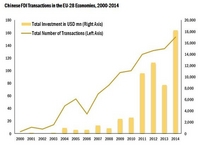

Until 2011, China was mostly a receiver of European investment, but then the debt crisis drove down asset prices. Some governments became desperate to privatize, and venerable corporations got less picky about potential investors. Chinese buyers acquired Volvo in Sweden, a large stake in Peugeot Citroen and fashion house Sonya Rykiel in France, the Piraeus Port in Greece, Pizza Express restaurants and the upscale clothing maker Aquascutum in the U.K. Chinese investment increased exponentially:

Most Chinese investment in Europe goes into existing, established firms. There are almost no greenfield projects. There's nothing wrong with private companies such as Pizza Express buyer Hony Capital, potential Potsdamer Platz investors Fosun International and Ping An Insurance, or Volvo savior Geely buying into European firms. Cross-border business is common these days. But when old European brands fall into the hands of Chinese state companies, it becomes geopolitics, too: European countries are, in effect, lending part of their heritage to the octopus that is the Chinese government so it can expand its global influence. "For the moment, Chinese investment seems like money falling from the sky, but it could turn ... into a Trojan horse introducing Chinese politics and values into the heart of Europe," Princeton University's Sophie Meunier wrote in a 2014 paper.

European investors in China are required to set up joint ventures with Chinese partners, and other restrictions apply in specific industries. The EU is trying to negotiate for more openness, but Europe remains at a disadvantage.

Europe needs a coherent policy for dealing with foreign direct investment, setting out clear guidelines for what's permissible, which investors are welcome and which are not. Why not require state-owned companies to put money into greenfield projects only? There is a clear rationale for such deals, including the investment of Chinese nuclear companies in the Hinkley power plant project in the U.K. It would also make sense to require foreign state-owned companies to work with local partners and take only non-controlling stakes, while allowing more freedom for private players. In China, of course, even private companies can serve as instruments of government policy. But at least they are, first and foremost, market agents that deserve equal opportunity to compete.

(인턴 남민주) |

|